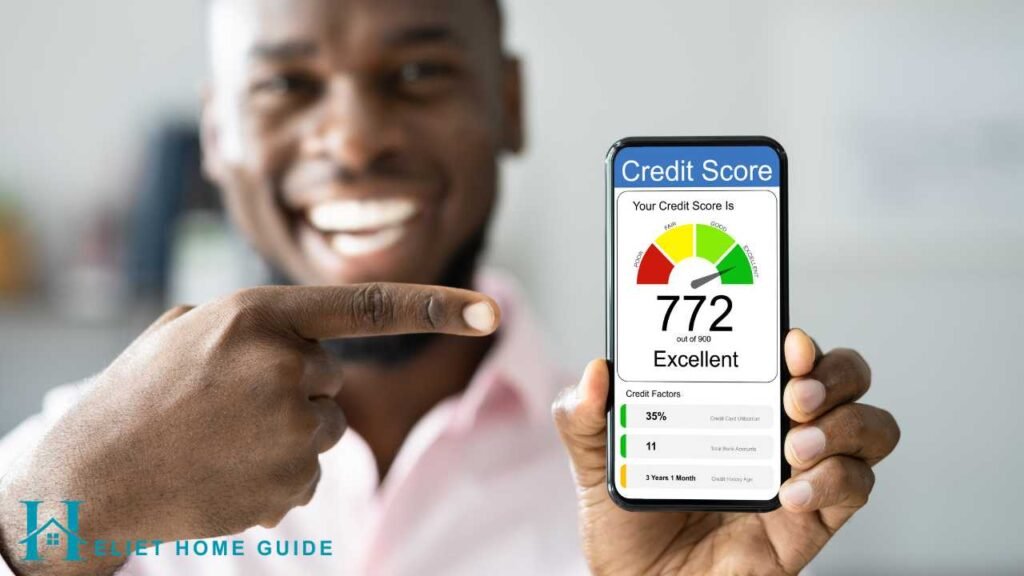

Your credit report shows where your credit stands by listing details about your debt and payment history. It also includes a credit score, often a FICO score, which helps lenders assess the quality of your credit. FICO scores range from 300 (the lowest) to 900 (the highest), with 700 or above considered good, while anything below can hurt your chances of qualifying for the lowest possible interest rates. You can order your credit report from one of the three major credit bureaus—Experian, TransUnion, or Equifax. A new law entitles Americans to a free report per year, which is available at www.annualcreditreport.com. Take this opportunity to monitor your reports, check for errors, and ensure your credit remains strongUnderstanding your full credit history is crucial when planning major financial decisions, such as buying a home.”

| Credit Score Categories and Their Meaning | Rating |

| 300 – 579 | Poor |

| 580 – 669 | Fair |

| 670 – 739 | Good |

| 740 – 799 | Very Good |

| 800 – 900 | Excellent |

“Your credit score is not just a number; it’s a financial reputation you build over time.” – Anonymous

Steps to Improve a Low Credit Score

A credit score can improve over time if you build good financial behavior. Negative credit reports and major issues like bankruptcy can remain for 10 years, but you can take steps to fix your credit.

- Pay monthly bills and loans promptly and in full every month to show responsible spending habits.

- Pay off credit cards on time and avoid making only the minimum payments to prevent a maxed-out balance.

- Avoid holding more credit cards than you need, as it may suggest cash flow problems to creditors.

- If you get turned down for a mortgage, request a written explanation from the lender to identify problems and find ways for improvement. Additionally, applying proven strategies for house hunting can help you secure a great deal when you’re ready to buy.

“Fixing a bad credit score is like training for a marathon—it takes consistency, patience, and discipline.” – Anonymous

Where to Find Reliable Credit Assistance

If you are facing severe financial trouble due to credit card debt, know that help is available. Many localities offer nonprofit credit counseling services that can assist you at little to no cost. These organizations help develop a plan and budget to pay off creditors and improve your financial standing over time. You can find them listed in the phone book or through online listings. However, be cautious—never trust a company that claims to fix bad credit histories for a fee, as such offers are often scams. Only good financial behavior over time can rebuild your credit.

“Financial freedom starts with knowledge and responsible credit management.” – Anonymous

- Key Factors That Affect Your Credit Score

- While you mention FICO scores, you don’t explain the key factors that determine a credit score, such as:

- Payment history (35%)

- Credit utilization (30%)

- Length of credit history (15%)

- New credit inquiries (10%)

- Credit mix (10%)

- While you mention FICO scores, you don’t explain the key factors that determine a credit score, such as:

| Factor | Weightage |

| Payment history | 35% |

| Credit utilization | 30% |

| Length of credit history | 15% |

| New credit inquiries | 10% |

| Credit mix | 10% |

“Your credit score is a mirror reflecting your financial habits—make sure it tells a good story.” – Anonymous

- Difference Between Soft and Hard Credit Inquiries

- You could mention that checking your own credit report (soft inquiry) does not affect your score, while lender inquiries for loans (hard inquiry) can lower it.

- Duration of Negative Marks on Your Credit Report

- You mention bankruptcy staying for 10 years, but other negative marks like late payments, collections, and foreclosures remain for 7 years.

| Negative Item | Time on Credit Report |

| Late Payments | 7 years |

| Collections | 7 years |

| Bankruptcies | 10 years |

| Foreclosures | 7 years |

| Hard Inquiries | 2 years |

“A mistake today doesn’t define your future. Take steps to improve your credit, and your score will follow.” – Anonymous

- Why a Good Credit Score Matters

- A strong credit score doesn’t just help with loan approvals; it also leads to lower insurance rates, better rental opportunities, and sometimes even job approvals. If you’re considering homeownership, it’s important to evaluate a neighborhood before buying.”

“A good credit score is like a VIP pass—it opens doors to better financial opportunities.” – Anonymous

Frequently Asked Questions (FAQs)

1. What is a credit history?

A credit history is a record of your past borrowing and repayment habits, including loans, credit cards, and payment behavior, which helps lenders assess your creditworthiness.

2. Why is a good credit score important?

A good credit score helps you qualify for loans, lower interest rates, better rental opportunities, and sometimes even job approvals, saving you money and improving financial stability.

3. How frequently should I review my credit report?

You should check your credit report at least once a year to monitor errors, identity theft, and ensure your financial health remains strong without unexpected issues affecting your score.

4. How can I improve my credit score?

Pay bills on time, keep credit utilization low, avoid unnecessary credit inquiries, maintain long-standing accounts, and diversify credit types to build a strong credit profile over time.

5. What negatively impacts a credit score?

Late payments, high credit utilization, loan defaults, bankruptcies, frequent hard inquiries, and short credit history can lower your score and affect loan approval chances negatively.

6. How long does it take to fix a bad credit score?

Improving a credit score takes time, usually a few months to years, depending on financial habits, debt repayment, and consistency in making timely payments.

7. What is the difference between a soft and hard inquiry?

A soft inquiry, like checking your own credit, doesn’t affect your score, while a hard inquiry from a lender for a loan or credit card may lower your score.

8. Does closing a credit card hurt my credit score?

Yes, closing a credit card can reduce your available credit, increase utilization, and shorten your credit history, potentially lowering your credit score.

9. How long do negative marks stay on a credit report?

Late payments, collections, and foreclosures stay for seven years, while bankruptcies remain for ten years, and hard inquiries last for two years on your credit report.

10. Can I get a loan with a low credit score?

Yes, but it may come with higher interest rates, stricter terms, and lower approval chances. Improving your score can help you qualify for better loan options.

Conclusion

Maintaining a strong credit score is essential for financial stability, influencing loan approvals, interest rates, and even job opportunities. By understanding your credit history, monitoring reports, and adopting responsible financial habits, you can build and maintain good credit over time. Fixing a low credit score requires patience, but consistent effort—such as timely payments and responsible credit use—can improve your financial standing. If needed, seek help from reputable credit counseling services, and always stay informed about factors affecting your credit. A good credit score is a powerful tool that can open doors to better financial opportunities and long-term success.

Rhys Henry is a Luxury Realtor & Senior Partner at Tyron Ash International, specializing in South East London & Kent Division. A dedicated real estate agent, Rhys is passionate about helping clients navigate buying, selling, and investing in luxury properties with expert guidance and industry-leading strategies.