Single-family homes are self-standing residences where a paying tenant, whether a person, group, or family, lives independently. These properties often increase in value, making them a strong real estate investment.

- Buyers prefer them for their privacy, while investors appreciate the efficiency of dealing with one tenant at a time.

- While they offer good income and price appreciation, there are drawbacks to investing in them, such as vacancies and a smaller supply of renters.

- Unlike an apartment building or multi-family home, if the unit is vacant or a tenant fails to pay, there are no other tenants’ payments to cover the costs until you fill it with a new tenant.

- Since apartments and condos are cheaper, many renters choose them over single-family homes, especially for short periods like a year, summer, or a month-to-month basis, making it difficult to find tenants consistently.

| Pros | Cons |

| High appreciation potential | Risk of vacancies |

| Easier to sell compared to multi-family homes | Limited rental income |

| Lower maintenance costs | Harder to find long-term tenants |

“Even on a small scale, real estate investing continues to be a proven way to build cash flow and wealth.” – Anonymous

Multi-Family Homes: A Reliable Rental Income Source

Multi-family homes are a great option for investors looking for steady rental income. These self-standing residences are occupied by two or more paying tenants, which can be individuals or families. While they look like single-family homes, they have separate entrances to provide tenants with a certain degree of privacy. Before deciding to invest in a multi-family home, consider key tips like tenant management and maintenance costs.

Key Insights for Multi-Family Home Investors

- Multi-family homes attract specific buyers, mainly real estate investors, which can make selling more difficult compared to a single-family home. However, an owner-occupier may also be interested if they plan to live in the property while renting out other units. Before investing, it’s crucial to assess the financial risks of homeownership.

- Rent payments for these properties are usually lower than expected because renters see them as apartments rather than standalone homes. Unlike owners of single-family homes, investors should expect lower high rents in certain neighborhoods due to the limited potential for premium pricing.

“Don’t wait to buy real estate. Buy real estate and wait.” – Anonymous

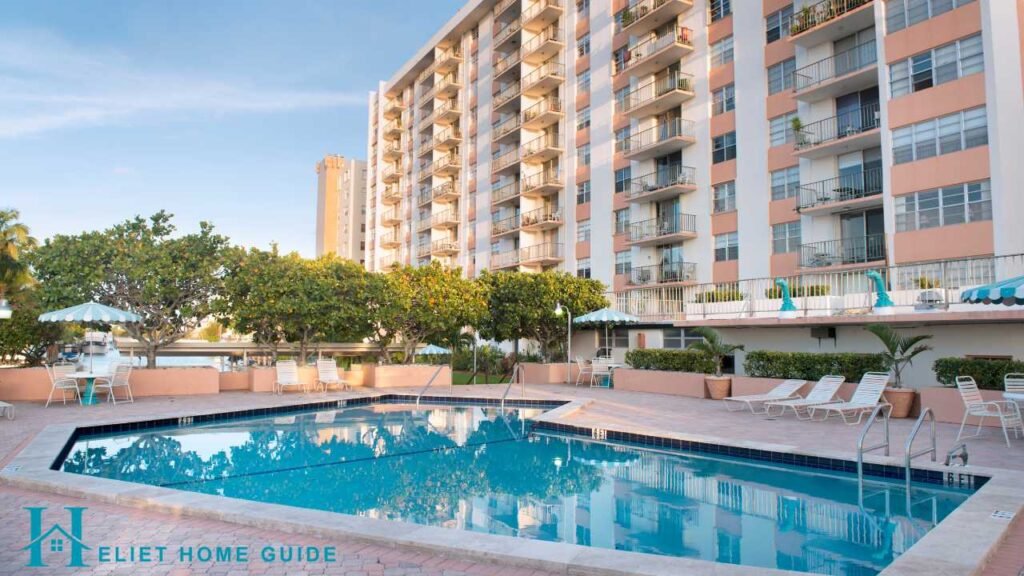

Apartments as an Affordable Investment Choice

Real estate investors looking for a steady rental income often buy a single apartment or an entire building within an apartment building. These housing units are grouped in a single building, making them one of the cheapest investment choices. However, since they are often seen as the least desirable housing option, they may attract renters with lower budgets. Despite this, an individual investor can still generate profits by targeting high-demand rental markets.

Smart Strategies for Apartment Investors

Investing in apartments can be profitable if managed wisely. Choosing a property in good condition with only minor updates, like fresh paint, new appliances, or new carpet, can increase its value and help boost the amount of rent you can charge.

- Minimal oversight means you won’t deal with central governing bodies like condo or co-op buildings, avoiding bureaucratic red tape and unnecessary fines.

- Apartments are relatively inexpensive for tenants, making it easier to fill vacancies and maintain steady income.

- Unlike condos, you won’t be under an ownership association or subject to unexpected special assessments for overall improvements.

| Benefits | Challenges |

| Steady rental income | Higher tenant turnover |

| Easier to fill vacancies | Requires property management |

“Owning a home is a keystone of wealth… both financial affluence and emotional security.” – Anonymous

Condos vs. Co-ops: Key Investment Considerations

- Investing in condos and co-ops can be a smart move, but understanding their ownership and arrangements is key. A condo offers direct property ownership, where you own the interior of the unit, including walls, floors, and ceilings, while a homeowners association (HOA) manages the common areas like the roof, plumbing, and electrical systems. However, this comes with monthly dues for maintenance, landscaping, and utilities in shared spaces. On the other hand, a co-op works differently—you buy shares in a company that owns the building, making you a shareholder rather than a direct property owner. The co-op board oversees management and is known to be more restrictive, with the power to charge fees and regulate who can buy or sell. While both options provide a structured living environment, investors must weigh the central governing body’s rules, costs, and flexibility before deciding. If you’re buying in a competitive market, knowing how to choose the right real estate agent can help.

| Feature | Condo | Co-op |

| Ownership | Own the unit | Own shares in the building |

| Monthly Fees | HOA Fees | Maintenance Fees |

| Restrictions | Fewer restrictions | Strict rules & approvals |

Smart Strategies for Condo and Co-op Investors

When investing in a condo or co-op, understanding regulation and rules is crucial. HOAs and boards often govern what items you can place in windows, what renovations are allowed, and whether you can rent or sublet the property. If you want more control, a single-family or multi-family home or an apartment may be a better investment.

- Tenant restrictions can be a challenge, as many renters must meet specific qualifications, like income levels, making it harder for investors to fill vacant properties.

- While minimal effort is needed for upkeep, as maintenance-free living means HOAs or boards handle hiring groundskeepers and even putting up holiday decor, this convenience comes at a cost.

- Expect monthly fees, which cover shared expenses but can cut into your profits, so factor them into your investment strategy wisely.

“The best investment on Earth is earth.” – Anonymous

Commercial Real Estate: Opportunities and Risks

Investing in commercial property can be rewarding, but it requires industry know-how and a deep understanding of market trends. Unlike residential real estate, where demand remains stable, office, retail, and industrial buildings are directly impacted by the local economy. Economic shifts can lead to rapid change in value and vacancy rates, making this type of investing riskier. If you’re just starting, it’s often best to begin with residential properties before moving into commercial spaces. If you’re considering this option, ensure you understand how to hire a real estate lawyer to protect your investment.

| Pros | Cons |

| Higher income potential | More complex regulations |

| Longer lease agreements | Vulnerability to economic downturns |

“Buy land, they’re not making it anymore.” – Anonymous

Profitable Strategies for Investing in Raw Land

For investors looking at raw land, it’s crucial to buy in areas with strong potential for price appreciation. Unlike existing property, undeveloped land cannot be rented out immediately, but if it is located in the path of progress, where the population and local economy are set for growth, its value will rise over time. As demand for housing and commercial buildings grows, landowners may see steady returns. However, since raw land tends to appreciate slowly, a long horizon is necessary when investing in this asset. Before making a decision, research steps to evaluating a neighborhood before buying.

“Real estate cannot be lost or stolen, nor can it be carried away.” – Anonymous

Smart Strategies for Investing in Raw Land

- Zoning restrictions play a major role in how landowners can develop land. Some areas are strictly zoned for single-family residential housing, while others allow commercial business use. Before purchasing, always confirm the land’s classification so it doesn’t impede your development plans.

- Always inspect maps from the local government to see how bordering properties might affect your investment. A piece of land next to a protected national forest can be more desirable than one near a shopping mall or office building. Ensure nearby zoning conforms to your expectations to avoid surprises in your backyard.

Vacation and Short-Term Rentals: What to Expect

- Properties listed on platforms like Airbnb and Vrbo offer high rental income potential but come with regulatory challenges, seasonal demand fluctuations, and increased maintenance costs.

- Investors should research local short-term rental laws and assess competition before committing. If you’re considering a second home for rental purposes, check out how to buy a vacation home and how to buy a vacation home overseas.

Mixed-Use Properties: Maximizing Revenue Streams

- These properties combine residential, commercial, and sometimes industrial spaces, offering multiple revenue streams.

- They are popular in urban areas and require strong tenant management skills.

Industrial Real Estate: Key Factors for Investors

- Warehouses, distribution centers, and manufacturing facilities offer long-term lease agreements but depend on the strength of the local economy.

- Investors should consider location, zoning regulations, and tenant stability when investing in industrial spaces.

Real Estate Investment Trusts (REITs): A Passive Income Option

- For those who want to invest in real estate without owning physical property, REITs provide a passive income stream.

- Publicly traded REITs allow investors to buy shares in real estate portfolios, diversifying their risk across multiple properties.

Final Thought:

With careful research and a well-thought-out strategy, real estate investors can achieve long-term success and financial stability.

“Investing in real estate is more than just buying a property; it’s about securing your future.” – Anonymous

Frequently Asked Questions

What is the best property type for beginner real estate investors?

Single-family homes are ideal for beginners due to lower maintenance, easier tenant management, and high resale value compared to other real estate investment options.

How do multi-family homes generate better rental income?

Multi-family homes generate steady rental income by housing multiple tenants, reducing vacancy risks, and spreading financial responsibility across multiple rental units for consistent cash flow.

Are apartments a good investment for long-term gains?

Yes, apartments can provide long-term profits, especially in high-demand rental markets, by maintaining steady occupancy rates and benefiting from increasing property values over time.

What are the main differences between condos and co-ops?

Condos offer direct ownership, while co-ops involve purchasing shares in a company owning the building, requiring board approvals for buyers and sellers, which can limit flexibility.

Why is commercial real estate riskier than residential?

Commercial properties depend on economic conditions, tenant stability, and market trends, making them more vulnerable to downturns, unlike residential properties with consistent housing demand.

How can investing in raw land be profitable?

Buying raw land in high-growth areas leads to long-term appreciation, potential commercial development opportunities, and increased property value as urban expansion progresses.

What are the biggest challenges of vacation rental investments?

Vacation rentals face regulatory restrictions, seasonal demand fluctuations, higher maintenance costs, and the need for strong marketing strategies to attract guests and ensure profitability.

Why are mixed-use properties a smart investment choice?

Mixed-use properties generate multiple income streams by combining residential, commercial, and retail spaces, reducing financial risk and maximizing rental income potential in urban areas.

What should investors consider before purchasing industrial properties?

Investors should assess location, zoning laws, tenant demand, and economic stability to ensure industrial properties provide long-term leases and consistent rental income.

How do REITs help investors enter real estate?

Real Estate Investment Trusts (REITs) allow investors to own shares in property portfolios, offering passive income and diversification without direct property management responsibilities.

Conclusion

Real estate investing offers a diverse range of opportunities, from single-family homes and multi-family properties to commercial real estate, raw land, and REITs. Each property type comes with its own risks and rewards, making it essential for investors to align their choices with their financial goals, risk tolerance, and market conditions. Whether you’re seeking steady rental income, long-term appreciation, or passive investment options, thorough research and strategic planning are key to maximizing returns. By understanding the nuances of different property types, investors can make informed decisions that lead to financial stability and long-term success in the real estate market.

Rhys Henry is a Luxury Realtor & Senior Partner at Tyron Ash International, specializing in South East London & Kent Division. A dedicated real estate agent, Rhys is passionate about helping clients navigate buying, selling, and investing in luxury properties with expert guidance and industry-leading strategies.